Securing adequate auto and home insurance for seniors presents significant challenges. Seniors face unique circumstances that make finding the best auto and home insurance for seniors both essential and complicated. Financial constraints and the need for higher coverage due to increased accident risk require careful planning and comparison shopping. This guide helps navigate these complexities to find the best auto and home insurance for seniors.

Toc

- 1. Understanding Seniors’ Unique Insurance Needs

- 2. Finding the Best Auto Insurance for Seniors: Discounts and Savings

- 3. Related articles 01:

- 4. Securing Affordable Home Insurance for Seniors: Key Factors and Savings Strategies

- 5. Best Auto and Home Insurance Bundles: A Cost-Effective Solution

- 6. Practical Guidance for Family Members Assisting Seniors

- 7. Conclusion

- 8. Related articles 02:

Understanding Seniors’ Unique Insurance Needs

As seniors age, their insurance needs evolve significantly. The risks associated with aging, such as increased likelihood of accidents and health issues, can directly impact insurance premiums. Understanding these unique factors is essential for finding the best auto and home insurance for seniors.

Increased Risk Factors

Seniors often face higher insurance costs due to increased risk factors. For instance, the likelihood of experiencing health issues or being involved in accidents can raise premiums. Studies by the National Highway Traffic Safety Administration (NHTSA) consistently show higher crash rates per mile driven for older drivers, particularly those over 80. However, this statistic doesn’t account for factors like reduced driving frequency in older adults. This nuance is crucial because while the risk per mile driven might be higher, the overall risk might be comparable to or even lower than younger drivers who drive significantly more.

This means that while insurance premiums may reflect increased risk, the reality of a senior’s driving habits may mitigate those risks. It is crucial to acknowledge that as individuals age, their reflexes and overall physical condition may decline, leading to a greater chance of incidents on the road. This makes adequate liability coverage particularly important for senior drivers, who may be more susceptible to accidents that could result in costly claims.

Financial Constraints

The financial realities of fixed incomes for many seniors necessitate finding affordable insurance without compromising crucial coverage. Many seniors live on limited budgets, making it essential to explore affordable insurance options that provide necessary protection. Family members should assist their senior relatives in budgeting for insurance premiums and exploring policies that provide adequate coverage without excessive costs. This may involve looking into options such as personal injury protection (PIP) and uninsured/underinsured motorist coverage, which can be especially valuable for senior drivers, ensuring they have the necessary safety nets in place.

Finding the Best Auto Insurance for Seniors: Discounts and Savings

One of the most effective ways to make auto insurance more affordable for seniors is to take advantage of available discounts. Many insurance providers offer various discounts tailored to seniors, helping them reduce their premiums significantly.

Discount Opportunities

- Mature Driver Courses: Completing state-approved mature driver courses can lead to substantial savings on auto insurance premiums. Organizations like AARP and AAA often provide resources for these courses, making it easy for seniors to qualify for discounts. These courses not only enhance driving skills but also demonstrate a commitment to safe driving.

- Safe Driving Records: Maintaining a clean driving record is crucial for securing lower premiums. Seniors should be encouraged to drive responsibly and avoid accidents or traffic violations, as these factors can significantly impact insurance costs.

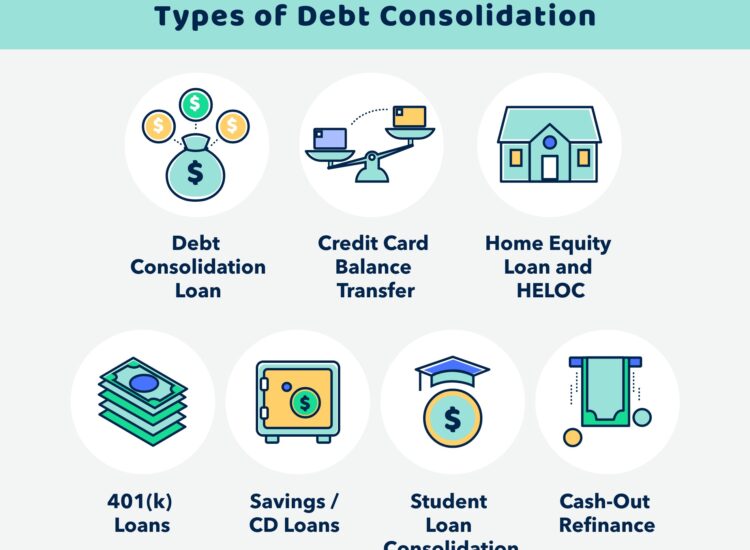

- Bundling Policies: Bundling auto and home insurance can lead to significant savings. The best home and car insurance bundle offers a way to simplify insurance management while potentially reducing costs. Many providers offer discounts for bundling, so it’s worth exploring this option when searching for the best auto and home insurance for seniors.

- Good Student Discounts: If family members are included on the policy, good student discounts may apply. This can be an excellent way to lower premiums while providing coverage for younger drivers.

- Multi-Car Discounts: If seniors have more than one vehicle, they can often qualify for multi-car discounts. This can further reduce overall insurance costs.

- Membership Discounts: Discounts may also be available for seniors who belong to specific organizations, such as AARP or other membership groups. Always inquire about these options when comparing quotes.

It’s important to note that the availability and extent of these discounts vary significantly by insurer and state. For example, while AARP offers discounts, their partnership agreements differ across insurance companies. Always compare quotes from multiple insurers to find the best deals, rather than relying on a single source of discounts.

Choosing the Right Provider

Selecting a reputable provider is crucial when searching for the best auto and home insurance for seniors. One well-known option is USAA, which offers excellent coverage tailored to military families, including seniors. Their reputation for customer service and member benefits makes them a strong contender in the insurance market.

1. https://thuyphannota.com/mmoga-best-car-insurance-in-sc-for-young-drivers/

2. https://thuyphannota.com/mmoga-the-best-health-insurance-for-small-business-a-comprehensive-guide/

5. https://thuyphannota.com/mmoga-best-car-insurance-for-college-students-a-parents-guide/

However, it’s also essential to compare quotes from multiple local insurers. Searching for the best auto and home insurance for seniors near me can yield local options that may better suit specific needs and preferences. Additionally, major national providers often have senior programs worth considering, as they can provide comprehensive coverage tailored to the needs of older drivers.

State-Specific Considerations

Different states have unique regulations and providers that can influence insurance options. For example, the best auto and home insurance for seniors in Texas may differ from what’s available in California or Illinois. Each state’s insurance laws can affect premiums, so understanding these nuances is vital.

- In Texas, many insurers may offer discounts for maintaining a good driving record, making it a favorable option for seniors who prioritize safe driving.

- California may emphasize coverage options that address natural disaster risks, given the state’s susceptibility to wildfires and earthquakes.

- Illinois has its own set of regulations that can impact insurance availability and cost, making it essential for seniors in the state to research their options thoroughly.

Emerging Trends in Senior Auto Insurance

As the insurance industry evolves, so do the options available to seniors. One notable trend is the emergence of telematics programs. These programs use devices installed in vehicles to monitor driving habits, rewarding safer drivers with lower premiums. Some insurers now offer discounts for using smartphone apps that monitor driving behavior. Conversely, some insurers are implementing stricter underwriting criteria based on age, leading to higher premiums for some seniors. Keeping an eye on these trends can help seniors and their families make informed decisions about their insurance options.

Securing Affordable Home Insurance for Seniors: Key Factors and Savings Strategies

When it comes to home insurance, several factors can significantly influence costs. Understanding these factors can help seniors secure the best home insurance coverage without breaking the bank.

Factors Affecting Home Insurance Costs

- Location: The home’s location plays a crucial role in determining insurance costs. Areas prone to natural disasters or high crime rates may result in higher premiums. Understanding these risks is vital when evaluating insurance options.

- Home Value: The value of the home directly correlates with insurance costs. A higher home value typically leads to increased premiums, so it’s essential to assess the current market value accurately.

- Security Features: Homes equipped with security features, such as alarm systems and deadbolts, can enjoy lower premiums, as they present a reduced risk to insurers.

Strategies for Lower Premiums

To secure affordable home insurance, bundling it with auto insurance remains a top strategy. The best home and car insurance bundle can lead to significant savings while simplifying management. However, while bundling often results in savings, it’s essential to compare bundled and unbundled quotes. Sometimes, separate policies from different insurers might offer better overall value, especially if one insurer offers significantly lower rates for either auto or home insurance.

Obtaining multiple quotes is another critical step. Consumers should not hesitate to shop around and compare various providers to find the best rates. Consulting resources such as Consumer Reports can provide valuable insights into the best home and auto insurance companies, helping families make informed decisions.

Important Considerations

When evaluating home insurance, adjusting coverage levels and deductibles can help manage costs. Higher deductibles can lead to lower premiums, but it’s essential to understand the trade-offs involved. Regularly reviewing coverage ensures it remains adequate as circumstances change, providing peace of mind.

Best Auto and Home Insurance Bundles: A Cost-Effective Solution

Bundling home and auto insurance can be a game-changer for seniors seeking affordable coverage. The advantages of bundling include significant savings and simplified management of insurance policies.

Advantages of Bundling

- Cost Savings: Bundling often leads to lower overall premiums. Insurance providers reward customers who choose to combine their policies, making it a financially savvy option.

- Simplified Management: Managing a single policy for both home and auto insurance can simplify the administrative aspect of insurance. This reduces the hassle of dealing with multiple providers and due dates.

- Better Coverage Options: Bundling can provide access to enhanced coverage options that may not be available when policies are purchased separately.

Tips for Comparing Bundles

When looking for the best auto and home insurance bundle in Illinois (or any other state), consider the following tips:

- Use Online Comparison Tools: Online tools can help you quickly compare quotes from different insurers, making it easier to identify the best deals.

- Review Coverage Options: Ensure that the bundled policy meets all necessary coverage requirements for both auto and home insurance.

- Look for Customer Reviews: Research customer experiences with specific insurers to gauge their reliability and service quality.

Practical Guidance for Family Members Assisting Seniors

Family members play a vital role in helping seniors navigate their insurance needs. Open communication and shared responsibility can significantly alleviate the stress associated with insurance management.

Importance of Communication

Open discussions about coverage requirements and available options can help demystify the process. Family members should encourage seniors to express their concerns and preferences regarding insurance coverage, fostering an environment of trust and understanding.

Sharing the responsibility of managing insurance policies can alleviate stress and ensure comprehensive coverage. Family members can assist seniors in reviewing policies, comparing quotes, and understanding the terms of their coverage.

Utilizing Resources

Utilizing online comparison tools and independent agents can further enhance the search for the best auto and home insurance for seniors. These resources can help identify suitable options and negotiate better deals on behalf of seniors.

Helping Seniors Understand Options

Providing guidance on how to understand insurance options and make informed decisions is crucial. Family members should take the time to explain complex terms and conditions in a straightforward manner, ensuring seniors feel confident in their choices.

Conclusion

Finding the best auto and home insurance for seniors requires careful planning and consideration. By understanding senior-specific needs, leveraging available discounts, comparing quotes from various providers, and utilizing bundling options, family members can significantly contribute to securing affordable and comprehensive coverage for their loved ones.

Remember to utilize online resources and communicate openly to ensure the best possible outcome. Start your search today using online comparison tools, and don’t hesitate to contact multiple insurance providers for personalized quotes. This proactive approach can lead to significant savings and peace of mind for both seniors and their families.